Have you been hearing more these days about the “ups” and “downs” in the stock market? These movements are expected in the stock market, but we are in unprecedented times and the increased global uncertainty has the stock market quite volatile. So, how do you handle those movements?

You overlook the short-term volatility in favor of the long-term trend.

When you invest, the concept of “volatility” is important to understand because there will always be volatility in the stock market. You can use these times of volatility to your advantage, but only if you understand it and are able to deal with it.

What is volatility?

Volatility: price movements that fluctuate more than normal in the short term. Can be new highs or new lows or erratic fluctuations. Someone once told me, feels like a roller-coaster.

Some stocks are more volatile than others. You can see the volatility below in the Amazon stock price chart. The line is not smooth and won’t be, especially in the short-term.

So, how do you deal with volatility and why should you overlook short-term volatility in favor of the long-term trend?

1. Time smoothens volatility

When you hear reports of the stock market going up and down within a short time period and you are invested in stocks, it is easy to panic. But investing is a long-term game and over a long period of time, the returns tend to smooth out. What you remember as short-term volatility won’t make that much difference 10 years later. For example, you may remember the steep decline in March 2020 at the inception of the pandemic and the ensuing fear, but in reality, it did not matter if you remained invested since then. Not only was the S&P500 Index’ – an index made of the largest 500 publicly traded companies – total return 18% in 2020, it is already up 12% year-to-date this year.

2. This is especially true for general stock market indices

Now, we are big fans of investing in the general stock market indices, such as the S&P500 Index and both beginners and professionals alike invest in the indices. They are a great investment if you prefer to invest and forget about your investment or if you don’t have the time to do stock specific research. Plus, they are a fantastic way for beginners to be introduced to the stock market when they start investing.

The long-term trend for the overall stock market will be up. But that may not necessarily be true for individual stocks, which have more company specific risks that could impact the stock price longer-term, such as increased competition. But if you pick a great company, like Amazon, the long-term chart is compelling. So, keep in mind that there are additional risks with specific stock investing.

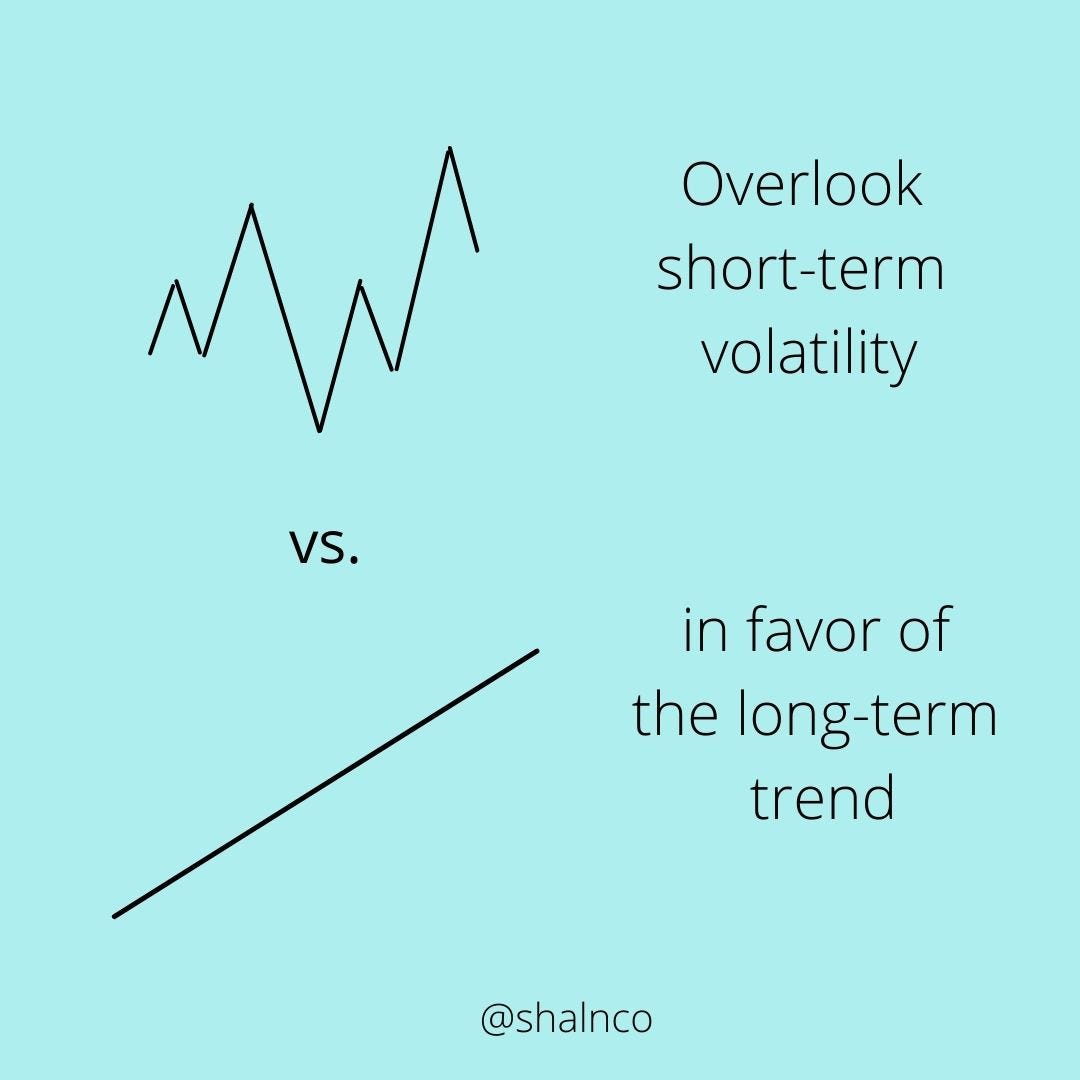

Also expect stocks to be more volatile than the market as a whole. In addition, certain assets, like cryptocurrency and specifically Bitcoin, have been very volatile, as you can see in the chart below. So, know what you are investing in and what the risks are to that investment. The greater the risk, the greater the volatility.

Bitcoin Price

3. Your mindset is key

We can’t stress this enough. Your mindset is critically important when you invest. When there is short-term volatility and the stock market drops 5% in a short time period, it is easy to become fearful and want to sell. But if you still believe in your overall investment thesis, then this is time where you need to take a step back, take a deep breath and focus your attention elsewhere if you are a long-term investor. It will be hard, really hard. But eventually the stock market does come back and returns over the long term end up higher.

For example, see the S&P500 Index returns below, during a short time period and over the longer time period. If you were able to keep your money invested and not panic during the volatile periods, you were rewarded. If you sold during the volatile times, you likely lost out. That is because it is nearly impossible to time the stock market – you cannot call the tops or the bottoms and if you manage to do that, you were probably just lucky. If you took your money out (i.e. sold your investment) during the volatile times, you likely missed the turn in the market when it would have started rising and you may have had to pay capital gains taxes if you had a gain on that sale. That just means you would have less to reinvest back in the market.

S&P500 Shorter Time Period

S&P500 Longer Time Period

Now, this does not mean that you never sell. You can certainly trim your position if there is too much volatility or a steep drop. Or if something happens to change your investment thesis. But otherwise, if you don’t need that money for years, then let it stay invested in the stock market. Else you may regret your decision by missing the turn in the market or any subsequent gains.

I’ll give you a personal example. I rode the stock market down all the way during the 2008 decline, firmly believing that there would be a turn in the market. But there came a point where I panicked as I just could not take the decline anymore and I sold my investments around March 8, 2008. Guess what happened? See the chart below? I sold at the worst possible time. At the bottom. And it took me some time to get back invested in the stock market. It was an eye-opening lesson for me.

The March 2009 Bottom

Your investing mindset is key and can make or break your investing returns. We have a fantastic mindset course if you want to get in the right investing mindset.

4. What causes volatility?

To be more comfortable with the concept of volatility – which will always be present when you invest, you should understand what causes volatility. Volatility is largely caused by uncertainty. The uncertainty can be caused by monetary policies, unexpected inflation or interest rate changes, economic and political landscape, national and global events. It can be an unknown risk that emerges all of a sudden. For example, a war in the Middle East can impact the price of oil, which can impact the price of gasoline in the United States, which will impact consumers and how much they have available to spend. This could impact discretionary stocks.

Another example could be higher than expected inflation, which would cause worries of higher interest rates, which will impact stock prices overall.

There will always be uncertainty when you invest. And thus, there will always be volatility.

5. So how can you deal with the stock market volatility?

There are a few ways to deal with the inevitable volatility in the stock market. You could be more diverse in your stock holdings and invest across different sectors. You could hold a general market index, like the S&P500 Index. You should focus on the long-term goals. Maybe you could rebalance your portfolio.

The likelihood of a possible loss hits human beings greater than the likelihood of higher returns – we just feel the loss greater. But that means that you are in danger of abandoning your long-term goals in the face of short-term volatility. This is why knowing why you are investing, what your long-term goals are, and how much you can invest without needing that amount for as long a time period as possible can help. If you need the money in a shorter time period, then don’t invest that money in the stock market. Again, your investing mindset is critical.

6. How can you use stock market volatility?

While it may be counter intuitive, think the opposite of what the market is thinking. If there is great volatility, there is likely great fear. You can use that to your advantage by buying great companies’ stock at a discount to its value when the price declines during periods of volatility.

For example, people who invested in the overall stock market when it dropped nearly 30% in March 2020 and who stayed with their investments, had a great return at the end of the year. People who had already done their research, had specific companies on their “watchlist” and who invested during that time period, likely also did well on their investments.

Conclusion

Volatility is part of investing and will always be present. You should know what volatility is and how to deal with it and you will be a better and more successful investor.

Key: overlook short-term volatility in favor of the long-term trend.

Check out our website SHALnCO for more resources on investing, including courses and eBooks.