Time is your friend

Stay the course.

When you invest, time is your friend. What does that mean? That means that you keep your money invested in the stock market without taking it out – literally, invest it and just be patient… and you will be rewarded for it.

Time is your friend.

Basically, said another way “Time in the market is far greater than timing the market”

There is no reason for you to sell your investments unless your investment thesis has changed or you need the funds for an unforeseen emergency (but that is why you establish an emergency fund before you invest). Interrupting the investment by selling it before you realize your return is doing a disservice to yourself, unless your investment thesis has changed.

By focusing on staying invested for the long-term, you give yourself a substantial advantage to compound your returns, thereby increasing them substantially. For example, frequent trading and market timing typically lead to worse performance than just keeping your money invested, especially if you invest in stock market indices, such as the S&P500 Index, or great companies, such as Apple or Amazon.

What is the impact of being out of the market?

It is impossible to time the market, which is why the famous saying “time in the market beats timing the market” makes so much sense. Getting the right time to sell and the right time to buy is pure luck because no one can see the future with any type of clarity and if you trade in and out of your investments, it is highly likely you will miss significant days in the market which will end up impacting your overall returns.

There is an exact price to missing these up days, as JPMorgan has stated in a recent report and as shown in the chart below.

You can see the drastic difference in returns if you miss the best investing days. Incredibly, missing just 10 of the best days more than halves your return!

Clearly, you do not want to miss any of the best days in the stock market and the way to do that is to stay invested in the market.

As the famous legend Jack Bogle has said: “The historical data supports one conclusion with unusual force: To invest with success, you must be a long-term investor.”

So how do you stick with long-term investing?

Focus on intelligent investing.

You can invest in the stock market indices, such as the S&P500 Index and you can forget about your investment for decades. If you decide to invest in specific stocks, then you still need to keep an eye on the businesses underlying those stocks to make sure that your investment thesis is still sound. This requires more active investing and more effort on your part to research your investment to begin with and then to actually keep an eye on the company over time. If you feel that your investment thesis with respect to specific stocks has in any way changed, then you should sell your investments in those specific stocks.

What is important is that you do your research and understand what you are investing in and why as well as the risks to that investment.

Be aware of fear and greed.

Be able to manage your emotions. The market has periods of fear and greed where you will be tempted to deviate from your long-term investing strategy and either sell when prices are declining or buy more when prices are rising. But stick with your strategy and don’t be swayed by market emotions. Take a look at our mindset course, which can help you to develop and crystallize your investing mindset. Mindset is critical to your investing success.

Stick with a strategy.

Develop an investment strategy and stick with it. This is easier said than done, especially when there are short-term periods of volatility. But know why you are investing and what you are investing in and do your best to stick with it.

You can definitely trim positions if they have risen substantially. And you should sell any losers in your portfolio – i.e. if your investments don’t increase in a rising market, there may be an issue and you should make sure you still believe in your thesis. And you should use the cash from these actions to invest next time there is a downturn in the market.

But you should not “panic sell” when markets drop or are volatile, as they will be at some point or another.

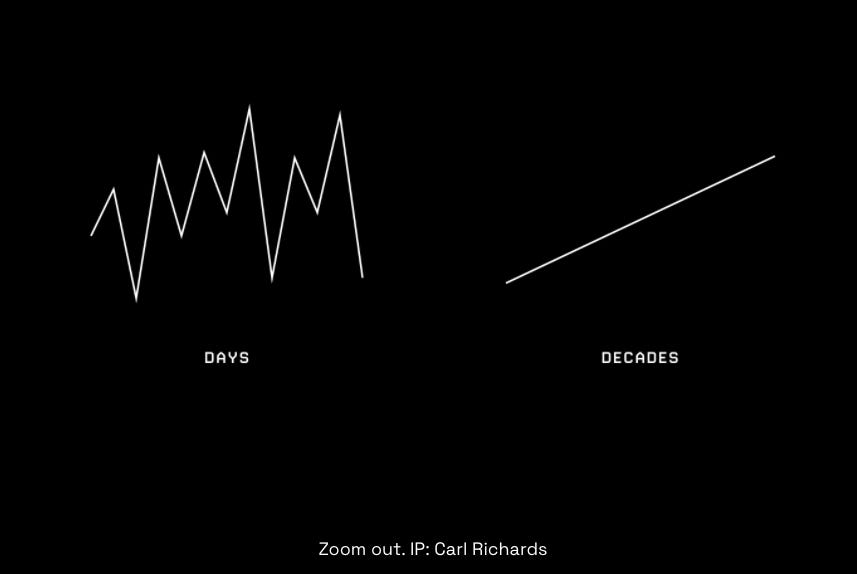

Zoom out.

Expect volatility. There will be short-term volatility in the stock markets and in stock investing. But the best thing you can do is to “zoom out” and see the trend, which smoothens over time and upwards. (See our post “Overlook short-term volatility in favor of the long-term trend” for more on this)

Stay the course.

Stay invested. Even if people around you are telling you to sell or urging you to buy, know what you want to do and why you want to do it. Understand that investing is a long-term game and be aware of your short and long-term goal as well as your risk tolerance and know how much you can weather the storm. Expect market turnarounds to happen suddenly.

Key: Time is your friend.

Check out our website SHALnCO for more resources on investing, including courses and eBooks.

Nothing in this email is intended to serve as financial or investment advice and you should do your own research and consult with appropriate advisors.